Manage Cash Drawer for Different Locations

This guide provides detailed instructions for managing cash drawers at multiple locations. It ensures precise tracking of cash in and cash out for smooth financial operations.

Understanding Terminologies

Cash Drawer

A cash drawer is a secure compartment within the point-of-sale (POS) system used to store cash, coins, checks, and receipts from transactions. It helps track cash in and cash out movements for services, retail product sales, and refunds, ensuring accurate financial management and security.

Create Cash Transaction (Cash In)

- The user can access the cash drawer from three entry points:

- Select a Location of the clinic from the dropdown menu.

- After selecting the location, click “Proceed” to view and manage its cash drawer.

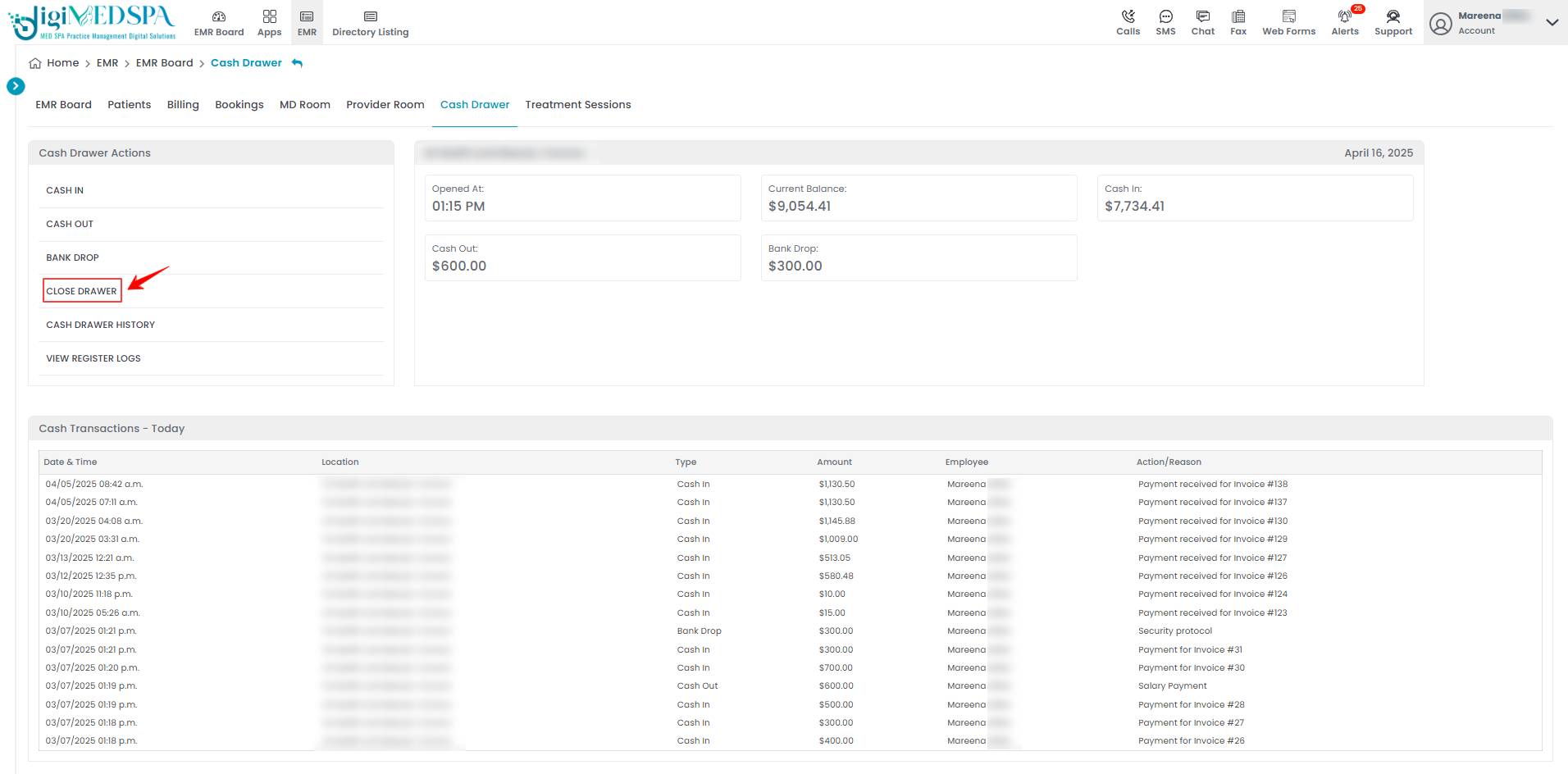

- When the cash drawer opens, you will see Cash Drawer Actions on the left and Today’s Cash Transactions at the bottom. It also displays the Opened At time, along with the amounts for Cash In, Cash Out, Bank Drop, and the Current Balance for that location.

Note: “Cash Drawer Actions” are the available functions within the system that allow users to manage the cash drawer, including cash in, cash out, reconciliations, and transaction tracking. These actions help maintain accurate cash flow records for a Med SPA location. “Today's Cash Transactions” refers to a log of all cash movements within the cash drawer for the current business day. “Opened At” refers to when the cash drawer was opened for the business day, helping track when financial activity began. “Cash In” refers to adding money to the cash drawer, including payment for services, product sales, or manual cash deposits. “Cash Out” refers to money removed from the cash drawer, including refunds, petty cash expenses, or withdrawals. A “Bank Drop” transfers excess cash from the drawer to a secure bank deposit to minimize on-hand cash risks. The “Current Balance” is the total amount of money available in the cash drawer after accounting for all cash in, cash out, and bank drop transactions.

Note: “Cash Drawer Actions” are the available functions within the system that allow users to manage the cash drawer, including cash in, cash out, reconciliations, and transaction tracking. These actions help maintain accurate cash flow records for a Med SPA location. “Today's Cash Transactions” refers to a log of all cash movements within the cash drawer for the current business day. “Opened At” refers to when the cash drawer was opened for the business day, helping track when financial activity began. “Cash In” refers to adding money to the cash drawer, including payment for services, product sales, or manual cash deposits. “Cash Out” refers to money removed from the cash drawer, including refunds, petty cash expenses, or withdrawals. A “Bank Drop” transfers excess cash from the drawer to a secure bank deposit to minimize on-hand cash risks. The “Current Balance” is the total amount of money available in the cash drawer after accounting for all cash in, cash out, and bank drop transactions. - To create a cash in transaction, click “Cash In” under Cash Drawer Actions on the left side of the screen.

- The Transaction Type will be automatically set to “Cash In.” Simply enter the Amount and Reason for the transaction, then click “Create Cash Transaction” to save it in the cash drawer.

Note: “Transaction Type” refers to the category of a financial transaction, such as cash in (adding money) or cash out (removing money). It helps track and classify cash movements within the cash drawer. “Amount” is the specific sum of money involved in a transaction. It represents how much cash is added (cash in) or removed (cash out) from the cash drawer. “Reason” is the explanation or purpose of a transaction, such as a product sale, service payment, refund, or petty cash expense. It ensures transparency and accurate financial tracking.The cash in transaction has been created successfully!

Note: “Transaction Type” refers to the category of a financial transaction, such as cash in (adding money) or cash out (removing money). It helps track and classify cash movements within the cash drawer. “Amount” is the specific sum of money involved in a transaction. It represents how much cash is added (cash in) or removed (cash out) from the cash drawer. “Reason” is the explanation or purpose of a transaction, such as a product sale, service payment, refund, or petty cash expense. It ensures transparency and accurate financial tracking.The cash in transaction has been created successfully!

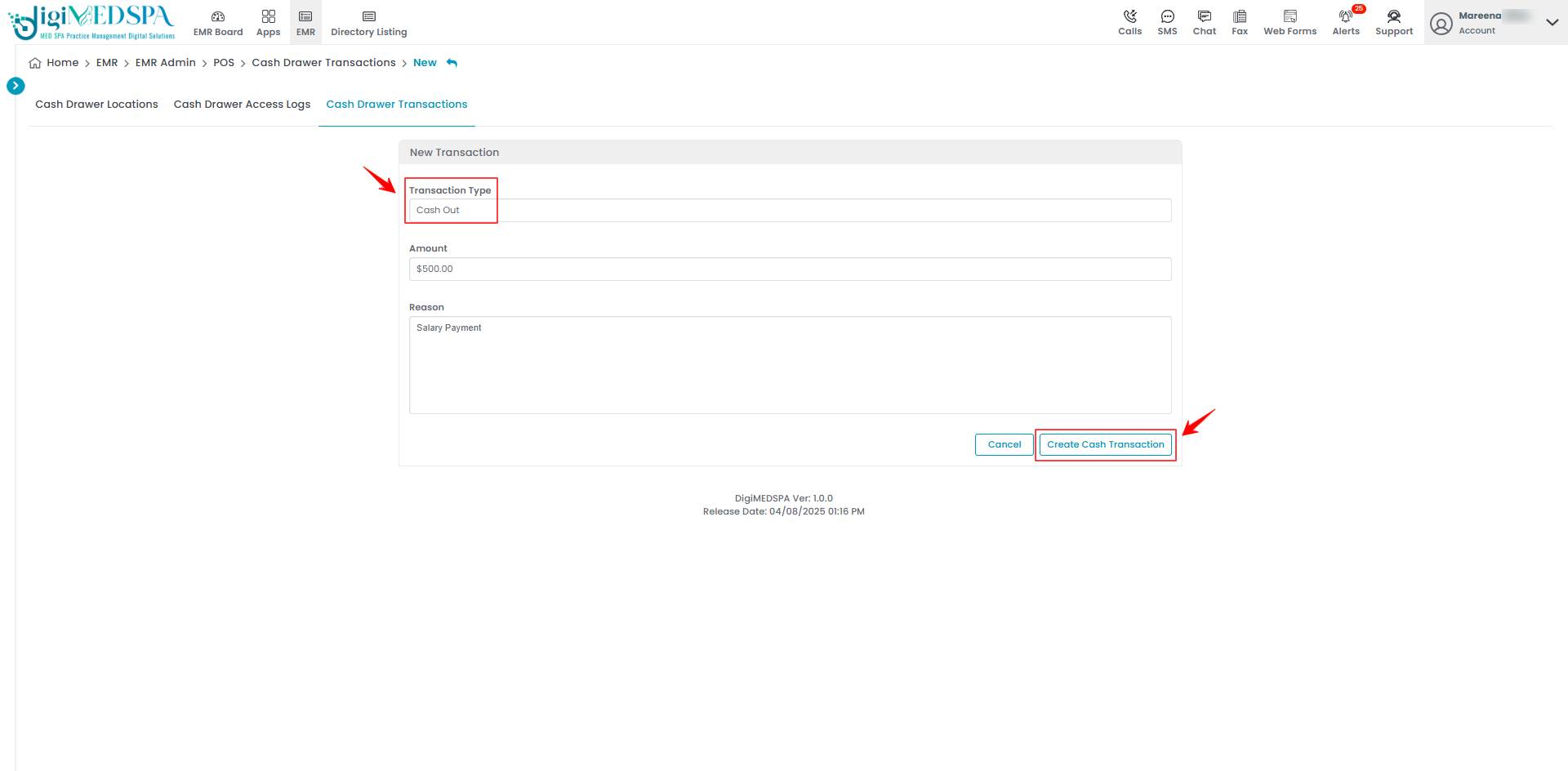

Create Cash Transaction (Cash Out)

- To create a cash out transaction, click “Cash Out” under Cash Drawer Actions on the left side of the screen.

- The Transaction Type will be automatically set to “Cash Out.” Simply enter the Amount and Reason for the transaction, then click “Create Cash Transaction” to save it in the cash drawer.

The cash out transaction has been created successfully!

The cash out transaction has been created successfully!

Create Bank Drop Transaction

- To create a bank drop transaction, click on “Bank Drop” under Cash Drawer Actions on the left side of the screen.

- The Transaction Type will be automatically set to “Bank Drop.” Simply enter the Amount and Reason for the transaction, then click “Create Cash Transaction” to save it in the cash drawer.

The bank drop transaction has been created successfully!

The bank drop transaction has been created successfully!

Close Cash Drawer

- To close the cash drawer, click on “Close Drawer” under Cash Drawer Actions on the left side of the screen.

Note: “Close Cash Drawer” refers to finalizing and locking the cash drawer at the end of a shift or business day. This includes reconciling cash transactions, verifying the current balance, and ensuring all cash in and cash out transactions are accurately recorded before closing.

Note: “Close Cash Drawer” refers to finalizing and locking the cash drawer at the end of a shift or business day. This includes reconciling cash transactions, verifying the current balance, and ensuring all cash in and cash out transactions are accurately recorded before closing. - Enter the Quantity for each Denomination, and the Amount will be calculated automatically. Once done, click “Close Drawer” to finalize and save the data.

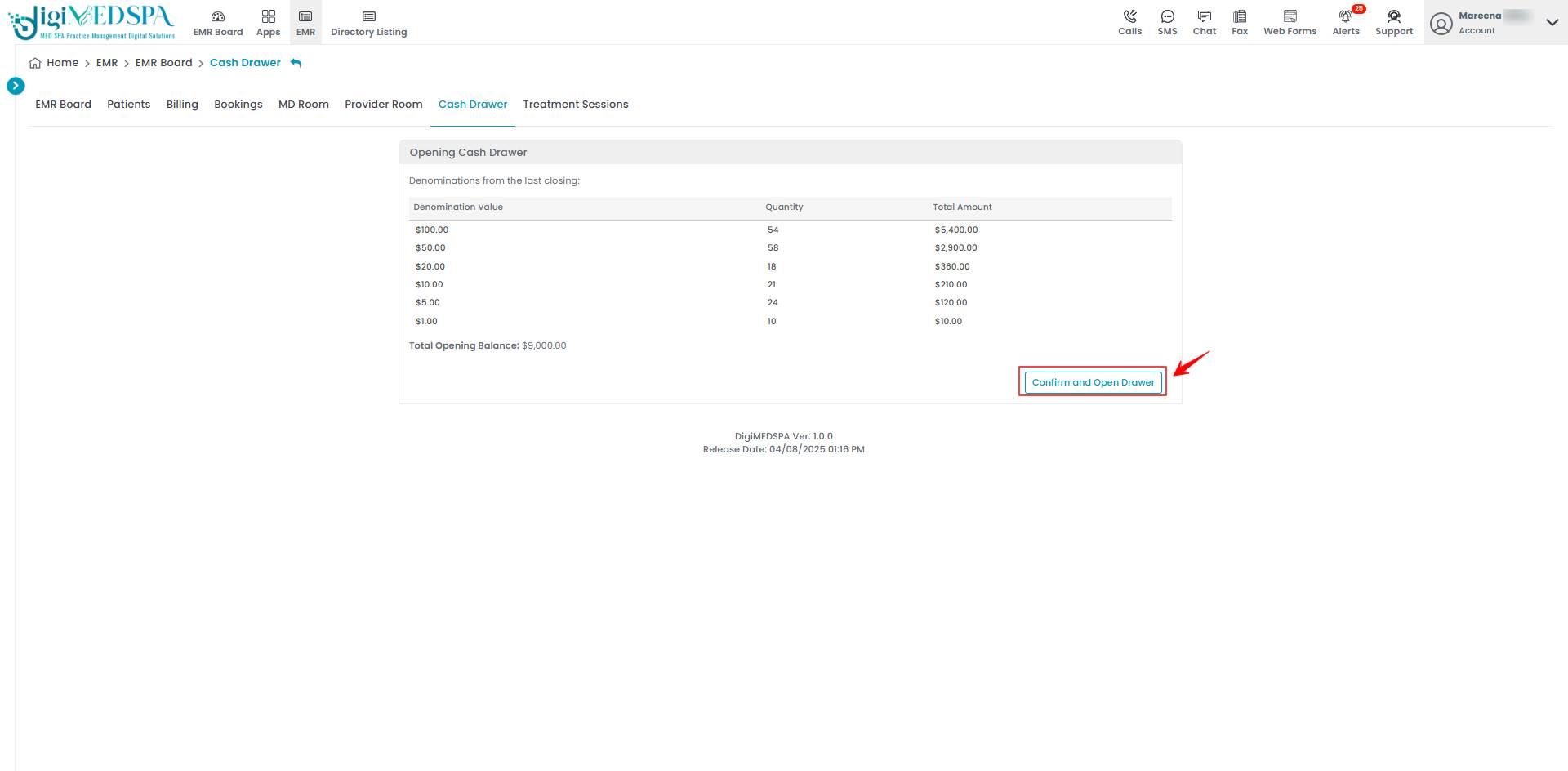

Note: “Denomination” refers to the different values of currency (bills and coins) in the cash drawer. It tracks and counts the exact breakdown of cash during transactions, reconciliation, and cash balancing.The cash drawer has been closed successfully!

Note: “Denomination” refers to the different values of currency (bills and coins) in the cash drawer. It tracks and counts the exact breakdown of cash during transactions, reconciliation, and cash balancing.The cash drawer has been closed successfully! - Before reopening the cash drawer, review the Denomination Values from the last closing. Once verified, click “Confirm & Open Drawer” to proceed.

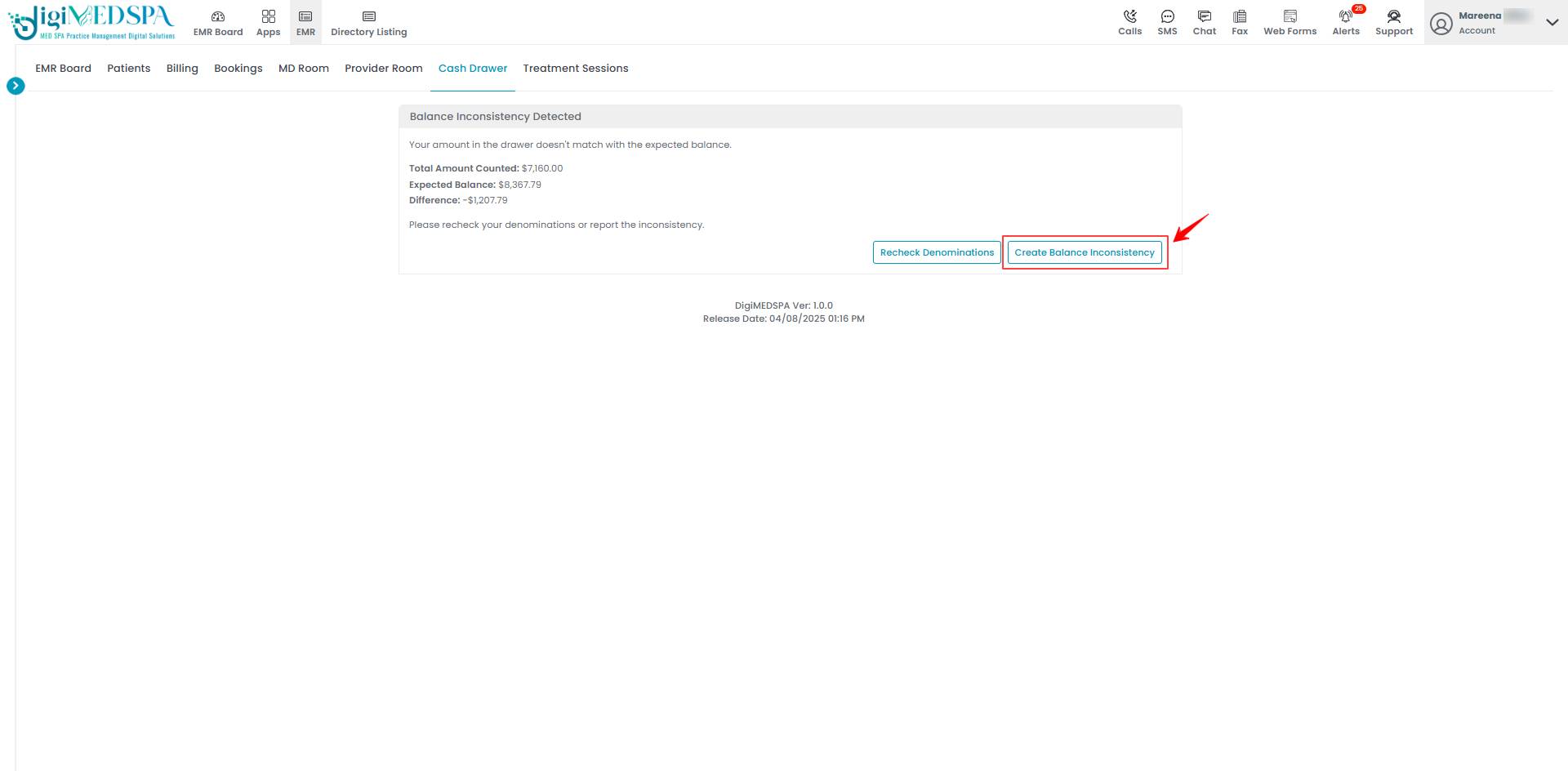

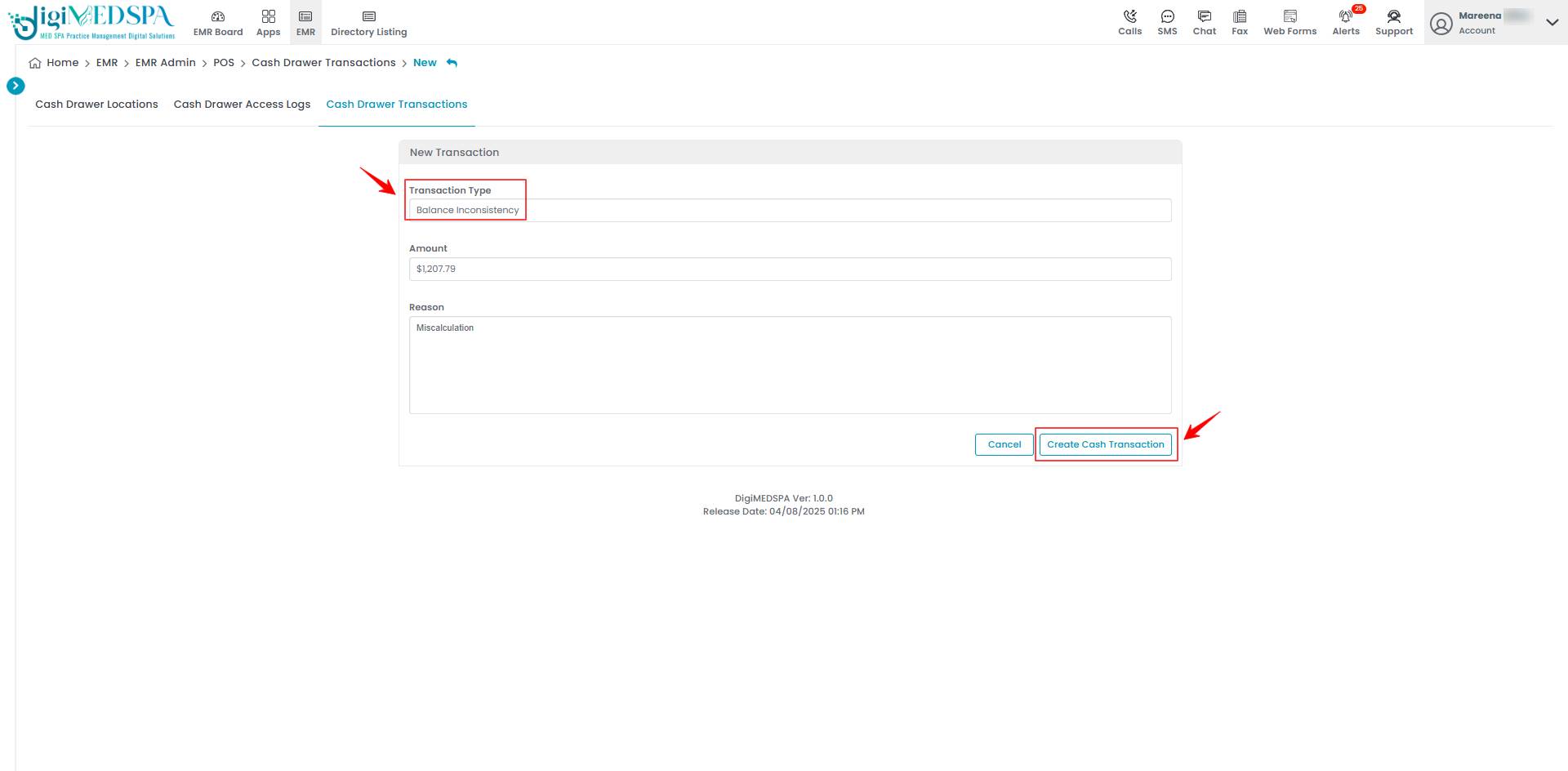

Report Balance Inconsistency

- If a balance inconsistency occurs when closing the drawer, click “Recheck Denomination” to review the quantities or “Create Balance Inconsistency” to report the issue.

Note: A “Balance Inconsistency” occurs when the cash in the drawer does not match the expected balance recorded in the system. This discrepancy can result from miscalculations, missing or extra cash, or incorrect transaction entries. The user can click “Recheck Denominations” to recalculate and confirm the denominations, helping to prevent any balance discrepancies.

Note: A “Balance Inconsistency” occurs when the cash in the drawer does not match the expected balance recorded in the system. This discrepancy can result from miscalculations, missing or extra cash, or incorrect transaction entries. The user can click “Recheck Denominations” to recalculate and confirm the denominations, helping to prevent any balance discrepancies. - The Transaction Type will be automatically set to “Balance Inconsistency.” Simply enter the Amount and Reason for the transaction, then click “Create Cash Transaction” to report the balance inconsistency.

View Cash Drawer History

- To view the cash drawer history, click on “Cash Drawer History” under Cash Drawer Actions on the left side of the screen.

Note: “Cash Drawer History” is a record of all past cash drawer activities, including cash in, cash out, bank drops, balance inconsistencies, and closing summaries. For detailed instructions on viewing the cash drawer history, refer to “View Cash Drawer History” user guide.

Note: “Cash Drawer History” is a record of all past cash drawer activities, including cash in, cash out, bank drops, balance inconsistencies, and closing summaries. For detailed instructions on viewing the cash drawer history, refer to “View Cash Drawer History” user guide.

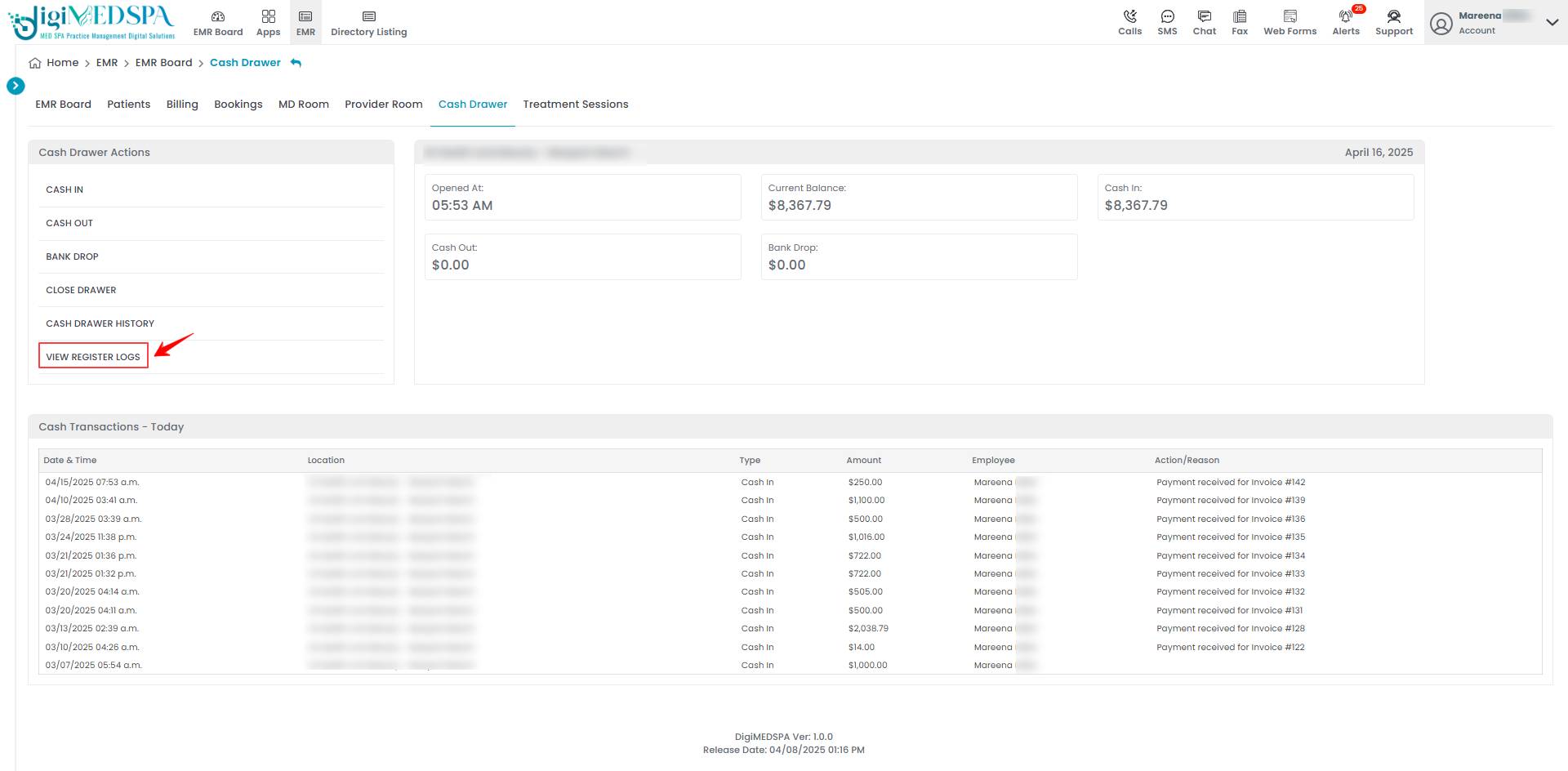

View Register Logs

- To view the register logs, click on “View Register Logs” under Cash Drawer Actions on the left side of the screen.

Note: “Register Logs” are detailed records of all cash-related activities within a cash drawer session, including cash in, cash out, bank drops, and balance inconsistencies. These logs help track financial movements, ensure accuracy, and maintain accountability for each session.

Note: “Register Logs” are detailed records of all cash-related activities within a cash drawer session, including cash in, cash out, bank drops, and balance inconsistencies. These logs help track financial movements, ensure accuracy, and maintain accountability for each session. - The Register Logs provide a detailed record of all Cash Drawer Sessions, showing the Transaction Time, Type, Amount, Employee, and Reason for each entry.